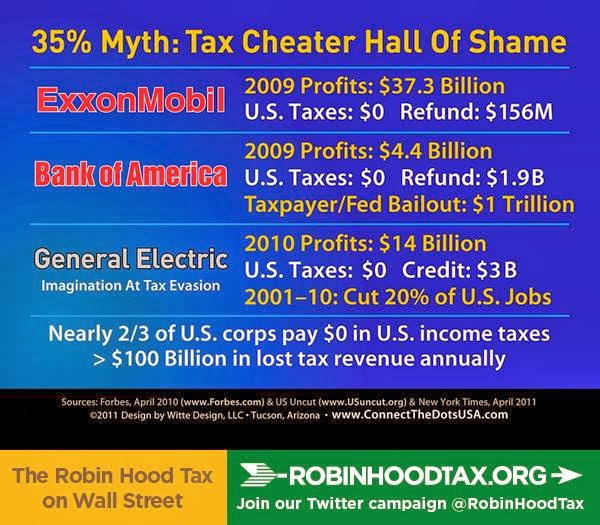

In addition to the corporate welfare bums, we have the corporate tax dodgers (similar to the draft dodgers of the 1960s, but these dodgers are rewarded with generous grants and refunds.)

Although the illustration below merely identifies a small sample of them, you can be assured there are many more. Moreover the picture is just as disheartening on the Canadian side of the fence. While there are no statistics available on how much Canadian Banks paid in income tax in recent years (at least none that I could find), the Canadian Labour Council has produced a report on falling corporate income taxes, i.e.

Due to ongoing corporate tax cuts, corporate income taxes make up a falling share of all government revenues. In fact, by the end of January [2012], corporations will have fully paid their share of taxes. ['Tax freedom day' for the rest of us was June 10th in 2013.]

The general federal corporate income tax rate stood at 28% in 2000. It was cut to 21% under the Liberals, and then cut in stages, from 21% to 15%, under the Conservatives. The most recent cut was from 16.5% to 15%, effective January 1, 2012.

Each one percentage point cut to the corporate income tax rate costs the federal government [and Canadian taxpayers] about $2 billion in annual revenues. ~ Canadian Labour Congress. http://www.canadianlabour.ca/sites/default/files/what-did-corporate-tax-cuts-deliver-2012-01-12-en.pdfHere are the U.S. figures: Read them and weep,

No comments:

Post a Comment